Technology investment evaluation is a critical discipline for organizations seeking to align digital initiatives with business strategy, financial performance, and long-term growth. As technology spending continues to rise across industries, leaders are under increasing pressure to justify investments, manage risk, and ensure measurable value. Without a structured decision framework, technology investments can easily become fragmented, reactive, and misaligned with organizational priorities.

This article presents a professional, expert-level decision framework for technology investment evaluation, while providing practical guidance for executives, finance leaders, IT managers, and decision-makers.

Understanding Technology Investment Evaluation

Technology investment evaluation is the process of assessing proposed or existing technology initiatives to determine their strategic value, financial impact, and operational feasibility. These investments may include software platforms, infrastructure upgrades, cybersecurity tools, automation initiatives, or data and analytics capabilities.

A structured evaluation framework ensures that decisions are based on consistent criteria rather than intuition, urgency, or vendor influence.

Why Decision Frameworks Matter in Technology Investments?

Technology investments are inherently complex. They often involve high upfront costs, long implementation timelines, and dependencies across teams and systems. A decision framework helps organizations:

- Align technology spending with business objectives

- Compare competing investment options objectively

- Reduce financial, operational, and security risks

- Improve transparency and stakeholder confidence

- Prioritize initiatives with the highest strategic return

Without a framework, organizations risk overinvesting in low-value tools or underinvesting in capabilities critical to future competitiveness.

Core Components of a Technology Investment Evaluation Framework

1. Strategic Alignment

Every technology investment should directly support one or more strategic objectives.

Key questions include:

- Does this investment enable revenue growth, cost reduction, or risk mitigation?

- Does it support long-term business strategy or digital transformation goals?

- Is it aligned with customer experience or operational excellence initiatives?

Investments that lack clear strategic alignment should be reconsidered or deprioritized.

2. Business Value and Expected Outcomes

Technology investment evaluation must define measurable outcomes.

Examples include:

- Increased productivity or automation

- Improved customer satisfaction or retention

- Reduced downtime or operational risk

- Faster time to market

Clear success metrics allow organizations to track performance and justify continued investment.

3. Total Cost of Ownership (TCO)

Focusing solely on purchase price or licensing fees is a common mistake.

A proper evaluation includes:

- Acquisition or development costs

- Implementation and integration expenses

- Training and change management

- Ongoing maintenance, support, and upgrades

- Infrastructure or cloud usage costs

Evaluating total cost of ownership over a multi-year horizon provides a realistic view of financial impact.

4. Return on Investment (ROI) and Financial Impact

Quantifying financial return strengthens decision-making.

ROI analysis may include:

- Cost savings from automation or efficiency

- Revenue growth enabled by new capabilities

- Avoided costs related to risk reduction or compliance

While not all benefits are easily quantifiable, a structured framework encourages disciplined financial assessment.

5. Risk and Uncertainty Assessment

Technology investments carry multiple forms of risk.

Key risk categories include:

- Implementation and delivery risk

- Vendor or technology obsolescence

- Security and compliance exposure

- Organizational readiness and adoption risk

A decision framework evaluates both the likelihood and impact of risks and identifies mitigation strategies.

6. Scalability and Future Readiness

Technology investments should support future growth rather than limit it.

Considerations include:

- Ability to scale with business demand

- Compatibility with existing systems

- Flexibility to support future requirements

- Vendor roadmap and innovation pace

Investments that solve today’s problems but create tomorrow’s constraints should be approached cautiously.

7. Organizational Capability and Readiness

Even the best technology fails without proper adoption.

Evaluation should assess:

- Internal skills and expertise

- Change management capacity

- Process maturity

- Leadership and stakeholder support

If organizational readiness is low, additional investment in training or phased implementation may be required.

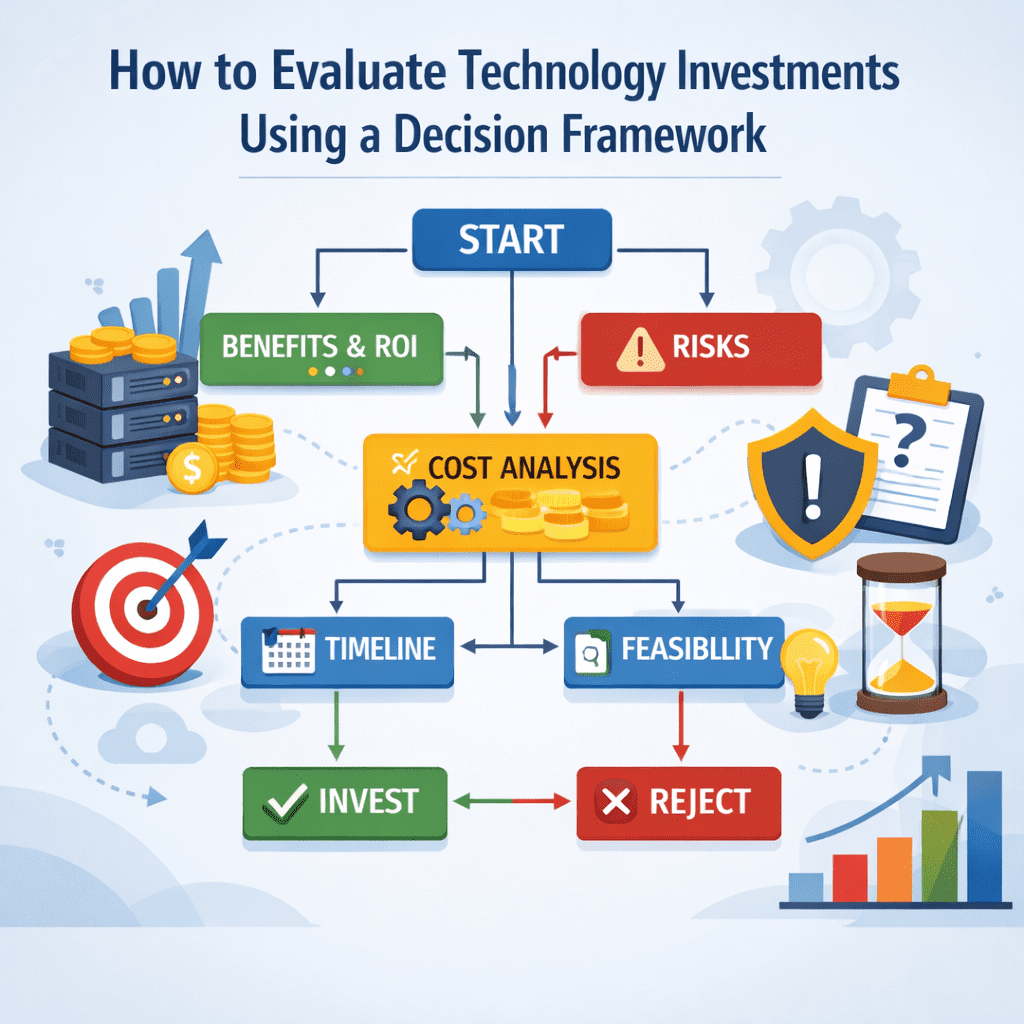

Applying a Structured Technology Investment Evaluation Process

A practical framework typically follows these steps:

- Define evaluation criteria and success metrics

- Assign weighted importance to each criterion

- Score each investment option objectively

- Conduct financial and risk analysis

- Review results with cross-functional stakeholders

- Approve, defer, or reject investments based on evidence

This structured approach improves consistency and reduces decision bias.

Common Technology Investment Evaluation Mistakes

Organizations often undermine value by making avoidable errors, such as:

- Approving investments without clear business cases

- Overestimating benefits and underestimating costs

- Ignoring integration and change management needs

- Making decisions driven by vendor pressure or trends

- Failing to revisit assumptions after implementation

A disciplined framework helps prevent these pitfalls.

Portfolio-Based Technology Investment Evaluation

Rather than evaluating initiatives in isolation, leading organizations manage technology as a portfolio of investments.

Portfolio evaluation enables:

- Balancing short-term wins with long-term capabilities

- Avoiding duplication of tools and platforms

- Aligning spending with risk appetite and strategy

- Reallocating resources based on performance

This approach improves overall return on technology spend.

Governance and Accountability

Strong governance ensures that evaluation frameworks are applied consistently.

Best practices include:

- Clear ownership for investment decisions

- Standardized evaluation templates

- Regular performance reviews against expected outcomes

- Defined exit criteria for underperforming investments

Governance transforms evaluation from a one-time activity into an ongoing discipline.

Measuring Post-Investment Performance

Technology investment evaluation does not end at approval.

Post-implementation reviews should assess:

- Achievement of business outcomes

- Actual vs projected costs

- User adoption and satisfaction

- Lessons learned for future decisions

Continuous measurement reinforces accountability and improves future evaluations.

Conclusion: Making Better Technology Investment Decisions

Technology investment evaluation is no longer optional—it is a strategic necessity. As organizations navigate digital transformation, limited budgets, and increasing complexity, structured decision frameworks provide clarity and discipline.

By evaluating strategic alignment, business value, cost, risk, scalability, and readiness, leaders can make informed, defensible investment decisions. When applied consistently, technology investment evaluation frameworks ensure that technology spending delivers measurable value and supports sustainable business success.

A disciplined approach turns technology investments from uncertain expenses into strategic assets that drive long-term performance.